Christians and Debt

What does the Bible say about Christians and debt? Let’s take a look, and then we’ll dig in and discuss how debt affects the lives of believers on a daily basis.

Proverbs 22:7 (NKJV) 7 The rich rules over the poor, And the borrower is servant to the lender.

Proverbs 22:7 (NKJV) 7 The rich rules over the poor, And the borrower is servant to the lender.

What is debt? In its most basic form, debt is a type of slavery. It is financial bondage.

You borrow money from a lender. As part of the deal, you sign an agreement to repay the lender the sum you borrowed. You must also pay the agree-upon interest charges.

So when you pay the debt in full, you’ve paid back much more than you originally borrowed. Sometimes the amount paid back can be astronomical when compared to the original amount borrowed.

The moment you sign a loan agreement, you’re in bondage to that company or that person. You are indebted to them (literally) and have to abide by the terms of the loan agreement. When the balance is paid in full, you are released from the contract.

Before we dive into the numbers and other debt-related math, etc., lets talk about the consequences of debt.

First, debt can wreak havoc with your emotions. Owing large amounts of money is stressful. And if you get behind on your payments, it can be devastating. Past-due payments can cause depression. It can ruin relationships. And marriages end up in divorce due to debt.

Financial stress is real. And it can be one of the worst types of stress, since there are typically no quick fixes for it. So once the horrors of debt and late payments set in, your life can go into a tailspin that’s hard to break out of.

Financial woes can leave scars that last for years. It can hurt your reputation and damage you emotionally. And once the damage is done, it takes time to fix it.

Now let’s look at some numbers!

Most people never bother doing the math when it comes to loans and what they actually cost you. And there’s a good reason for that. Because they know if they do the math, they won’t like what they see!

But, because we’re dealing with reality here, let’s take a quick look at some real numbers!

Let’s look at the ever popular credit card. Most people have at least one credit card. A lot of people have more than one!

Let’s look at the ever popular credit card. Most people have at least one credit card. A lot of people have more than one!

Let’s say that a card has a balance of $3,000 USD. And let’s say that the interest rate on that card is 16%. The $3000 balance would put the minimum monthly payment at roughly $120 per month.

We arrived at the $120 amount based on paying 4% of your balance as the minimum monthly payment. It’s what most card companies use as their standard payment amount. Fairly affordable, right?

But wait! Let’s look at those numbers and see what that $3,000 balance is really costing you.

First, making the minimum payment of $120 will stretch the length of time until it’s paid off to 102 months. That’s over 8 years! 8 1/2 years, to be exact.

And do you know what that 8 1/2 years will cost you in the end? $4151.82.

So instead of paying back the $3000 you originally owed, you’ll be paying them a total of $4151.82. That’s over $1150 in interest charges. That’s money that could have been in your own pocket. But it went to the bank, instead.

This is why we’re writing about Christians and Debt.

We hate seeing people fall into this kind of financial slavery. It deprives people of their hard-earned money. It also steals their joy and their sense of security, as they wrestle to stay afloat in a world of sinking debt.

And keep in mind that this is just one credit card. What about the families that have 2, 3 or 4 cards? And let’s throw a car loan or two into the mix. It gets ugly pretty fast at this point. And then you add a mortgage into the picture and you have a recipe for disaster.

It’s no wonder both the husband and wife have to work full-time jobs. And it’s not unusual these days to have both people working full time and one of them working a second, part time job.

What Happens if Your Income Drops?

When you’re floating large amounts of debt, it doesn’t take much to really throw things off kilter. If there is no savings account or emergency fund, just two weeks of lost pay can put you in grave danger.

When you’re floating large amounts of debt, it doesn’t take much to really throw things off kilter. If there is no savings account or emergency fund, just two weeks of lost pay can put you in grave danger.

Missing a couple of payments on your credit cards, or falling behind on your car loan can create a domino effect that can bring the entire house of cards crashing down. It happens much more quickly than most people realize!

And once that ball starts rolling, it’s extremely difficult to stop. Sometimes something as simple as an unexpected lengthy sickness and missed time at work to open a huge chasm. And you watch helplessly as your entire little empire begins falling into it. Gone!

So what can you do? How do you stop this from happening to you?

Step #1 – don’t put another thing on credit. Don’t run up any more debt. None!

Start by buying only what you can afford to pay cash for. If you can’t pay cash, don’t buy it. To aid with this, remove your credit cards from your wallet and store them at home, in a safe place.

Sliding that card at the store is way too easy. Make it hard for for yourself to charge anything new. Make it downright difficult. Buying stuff on credit cards can be a hard habit for some people to break, so don’t be surprised if you really wrestle with this.

But be strong and don’t give in to the temptation to buy more stuff that you don’t need and that you can’t afford to pay cash for. It will get easier. And if you’re having a hard time, just remind yourself of the thousands of dollars you’re paying to the credit card companies in interest charges.

Remember that it will take time to fix this situation. As we mentioned before, there are typically no quick fixes. Once the debt reaches a certain point, the only cure is meticulous money management and an extremely dedicated effort to pay it off as quickly as possible.

Honestly, the best way to stop using your credit cards is to destroy them. Run them through a shredder or cut them up with scissors! This will be the first big step.

Honestly, the best way to stop using your credit cards is to destroy them. Run them through a shredder or cut them up with scissors! This will be the first big step.

Step #2 is to call the card companies for each and every card that you own and tell them you want a lower interest rate.

If you’re current on your payments and you have a good payment history with them, they will lower your interest rate many times, just because you asked them to do so. And don’t just ask the first person who answers the phone. Ask them, and if they don’t help you, ask to speak to a supervisor! Be persistent. Many times this can result in a significant savings on the interest rate.

If they refuse to lower the interest rate, tell them you want to close the account. This will remove the ability to use the card. It will also guarantee that your balance will never do anything but go down as you make your payments. After closing the account, destroy the card.

Step #3 – If they give you the lower interest rate, thank them kindly and say goodbye. Wait 30 days or so and call them back. When you call them this time, tell them you want to close your account. If they ask why, and they probably will, just tell them you want it closed. They don’t need to know why!

Do step #2 and step #3 for every card you have. And be sure to destroy the cards as you close each account. Remember, you’re doing this for your own good. It might seem awkward at first. It may even feel uncomfortable, knowing that you’re getting rid of these cards. But you’ll be better off for it.

Now, what do you do if you’re falling behind on your payments?

Get help. Don’t try to handle it on your own if you’ve fallen into this situation. Creditors can be nasty when you fall behind. Their one goal is to collect the money you owe them. They’re not concerned with your situation. And they don’t care why you got behind. They just know that you have fallen behind.

Get help. Don’t try to handle it on your own if you’ve fallen into this situation. Creditors can be nasty when you fall behind. Their one goal is to collect the money you owe them. They’re not concerned with your situation. And they don’t care why you got behind. They just know that you have fallen behind.

So if you’re behind on payments and it looks like there’s no way for you to catch up fairly quickly, you need a debt management company to go to bat for you. Debt management companies specialize in helping people in these situations take control of their debt and get it paid off in a reasonable amount of time.

They don’t loan you money. This is not a debt consolidation program. They help you manage your debt and get your bills paid off on a specific schedule. They work with you, on your side, not on the side of the creditors. And they can save you thousands of dollars in interest charges!

How Does Debt Management Work When it Comes to Christians and Debt?

How do they do what they do? How do they save you money? Simple. They have agreements with most of the major credit card companies that helps them negotiate a lower interest rate for you.

You contact them and fill them in on your situation. Typically you’ll need to make a couple of phone calls. One of the calls will usually be lengthy, as they go over all of your credit card accounts with you and get all of the necessary information that will allow them to help you.

Once they have your information, they do some calculations and tell you how much they can save you. They will also give you an approximate dollar figure for your monthly payment on their program. And then they will tell you how long it will take for you to have all of these bills paid in full.

If you like the sound of what they tell you, you tell them that you want to proceed and they will send you a written agreement for you to sign. Signing the agreement or contract will give them permission to contact your creditors and begin negotiating your new interest rates.

Please understand that they do not negotiate lower balances. You owe what you owe. You ran up the debt, It’s up to you to pay for it. The only thing they can help you to get lowered is the interest rates.

The amount that your interest rate gets lowered will vary. Each credit card company has specific policies when it comes to debt management. Some are very good to work with and will lower your rate significantly. While others will make a token adjustment that won’t make a lot of difference.

So you might be asking why even bother if some of the card companies won’t lower your interest rate much. Good question. And here’s why you should still get into a debt management plan: Harassing phone calls.

Creditors are known for making harassing phone  calls if you fall behind on your payments. They will call you from 9 AM until 10 PM. They don’t care if you’re eating dinner, trying to spend time with your children or tending to other things. They want their money and they will stop at nothing to make sure you know that.

calls if you fall behind on your payments. They will call you from 9 AM until 10 PM. They don’t care if you’re eating dinner, trying to spend time with your children or tending to other things. They want their money and they will stop at nothing to make sure you know that.

Their goal is to intimidate you and bother you until you pay up.

But once you sign an agreement with a debt management company, they begin contacting each creditor to let them know that you’re onboard with them. And one by one, those terrible phone calls stop. This can bring a great sense of relief after trying to avoid those phone calls for weeks, or even months. This factor alone makes it worth your while to use a debt management company.

And on top of that, many of these companies are non-profit, so they charge little or nothing for their services. It’s not that they work for free. They don’t. But what little they do charge, is a pittance compared to what they can save you in interest charges and penalties.

Finding the right debt management company might seem like an intimidating prospect. Especially if you’ve never had to do this before. But it doesn’t have to be intimidating or complicated. Your best bet is to work with a company that’s established and has been around for a while.

Any company of this type that’s been in business for more than a few years will have developed a reputation, either good or bad. Do some homework. Spend some time online researching and reading customer reviews. Make sure you read reviews that aren’t just found on the company’s website. Find some in various places and go through them thoroughly, so you can get a really good feel for each company’s reputation.

Just remember that when you’re reading the reviews, you’ll never find a company that has 100% positive customer feedback. There will always be people who are unhappy with the services they receive, even if the company in question did everything correctly. Some people just like to complain.

But if the vast majority of the reviews you read are positive, you can be pretty sure that company is a good one to consider. And sometimes just calling and speaking with a company representative will give you a good feel for how they operate and whether they run a tight ship or not.

One company that we know of is Christian Credit Counselors. They are a registered non-profit company and have been in business for a long time. They offer a lot of good resources, in addition to helping you get your debt under control. Getting started with them is as easy as filling out a short form or giving them a call at their toll-free phone number.

And one last thing about debt management programs. They can only help you with unsecured debt. This would be credit cards, personal loans and similar debt where there is no collateral. If there is an item being used as collateral, such as a car loan or similar, it cannot be placed into a debt management program.

Please note that the company that we linked to and mentioned isn’t the only company available. There are others. Do some research and do your homework. Read customer reviews. Call and talk to a few of them personally. But, whatever you do, do something!

Does Debt Settlement work for Christians and Debt?

Three words. Don’t Do It!

Debt settlement can sound very inviting. How does debt settlement work? If you’re behind on your accounts, you can call the creditors and tell them that you want to settle your debt with them. You can negotiate with them and get them to accept a dollar amount that’s less than what you actually owe.

Debt settlement can sound very inviting. How does debt settlement work? If you’re behind on your accounts, you can call the creditors and tell them that you want to settle your debt with them. You can negotiate with them and get them to accept a dollar amount that’s less than what you actually owe.

Most companies are willing to do this, simply because they want to get some of the money that you owe them. They’d rather collect part of the debt than to get none of it.

For example, if you owe $5,000, they might settle for $3,000. Maybe even less. Sounds inviting, doesn’t it? Paying pennies on the dollar sounds good when you can walk away from it with a zero balance.

But, and this is a BIG but, despite the fact that it sounds so good, it can actually do more harm than good. When you settle a debt, it goes on your credit report as a debt that wasn’t paid in full. It gets marked as paid less than owed.

Wait. What? Yes, that’s right. When you settle a debt, even though the company agrees to accept the agreed-upon amount and mark the debt as paid in full, it goes on your credit report as “paid less than owed”.

So, even though you spent time negotiating and then reached an agreement with the creditor, there will be scars on your credit history that will take a long time to heal. Some will say that settling debt is no better than leaving it unpaid. The only exception to that is the fact that you at least made an effort to pay them, and you can keep your conscience clear knowing that.

So when it comes to debt settlement, think about it very, very hard. Weigh the consequences before deciding to take this option. And get advice from a financial advisor or someone you know who understands credit scores, etc.

Christians and debt – The Bankruptcy Option

Bankruptcy. Just the word “bankruptcy” conjures up visions of something that’s taboo; very bad. Most people think of bankruptcy as something that’s underhanded and downright immoral. Some people would say it’s evil. Others might say it’s for people who are lazy and don’t want to pay their debts.

Bankruptcy. Just the word “bankruptcy” conjures up visions of something that’s taboo; very bad. Most people think of bankruptcy as something that’s underhanded and downright immoral. Some people would say it’s evil. Others might say it’s for people who are lazy and don’t want to pay their debts.

None of this is true. Although bankruptcy can be abused, and no doubt it has been to some degree, it is a legitimate answer to the debt problems of a small percentage of people.

But bankruptcy should never be your first choice, as it has consequences that will take some time to get over. It leaves some pretty big scars on your credit report that will take a long time to heal. And it can make some people feel ashamed that they did it. But keep in mind that the scars will heal. And if bankruptcy is done for legitimate reasons, there is no reason whatsoever to feel guilty about it.

Bankruptcy is a protection mechanism for people who have extenuating circumstances that they just simply can’t overcome. Sometimes things can go terribly wrong for people, and no matter how good their intentions were, they just can’t pay their debts.

This can happen if there is a sudden loss of employment or if something else happens that causes a drastic decline in income. In most of these situations, the bottom falls out unexpectedly and a person is left with debts that they can’t afford to pay.

If this happens, a good bankruptcy attorney can take your case before a federal bankruptcy court and have your debts forgiven. When everything is said and done, your creditors will be told by the bankruptcy court that they will not be receiving the money that you owe them. And because this is something that the court declares and records, the creditor has no choice but to abide by it.

They cannot contact you, ever, about the money that you owed them. They can’t call you. They can’t send you letters. They can’t send you statements. The debt is canceled. End of story.

Bankruptcy is Scriptural

That’s right. Bankruptcy is mentioned in the Bible. No, the word bankruptcy isn’t used outright. But the Bible does deal with forgiveness of debt, nonetheless.

Matthew 18:26-27 (NKJV) 26 The servant therefore fell down before him, saying, ‘Master, have patience with me, and I will pay you all.’ 27 Then the master of that servant was moved with compassion, released him, and forgave him the debt.

Deuteronomy 15:1-2 (NKJV) 15 “At the end of every seven years you shall grant a release of debts. 2 And this is the form of the release: Every creditor who has lent anything to his neighbor shall release it; he shall not require it of his neighbor or his brother, because it is called the Lord’s release.

These are just two verses that refer to the forgiveness or canceling of debt. It’s something that God made allowance for centuries ago. And most modern governments also have laws governing this, offering a form of protection for people who have fallen on hard times and have no way of catching up.

Now, with all of that said, please remember that this is not something that should be used to make up for frivolous spending habits or poor money management. It is not something that should be done as a quick way of getting out of debts if you can afford to pay them, even if it takes several years to do so.

And bankruptcy laws are not something that should be abused. Debts should not be run up purposely, with the idea of filing for bankruptcy at some point in the future to get out of paying what you owe. This is illegal and immoral.

And bankruptcy has its consequences.

Filing for bankruptcy is something that needs to be taken very seriously. It’s not a joke. It basically means that you are making a statement that you have absolutely no means of paying the debts you owe.

Here’s what happens if you decide to file for bankruptcy. First, every single credit account you have will be closed. When you file for bankruptcy, the court system will notify all of your creditors. The moment they get this notification, they will close your accounts with them, even if you have never had a late payment and even if you wanted to keep that account open.

When you file for bankruptcy, you will be given a case number by your attorney. You will use this case number and contact every one of your creditors and notify them that you have filed for bankruptcy. You will give them your case number. You will also be required to give them your attorney’s name and contact information.

At that point, your creditors are no longer allowed to contact you regarding this debt. It doesn’t mean that your debt has been canceled. It just simply means that they can no longer call you, send you letters or use a third party collection agency to try to collect the debt.

After you have filed and before you actually go to court, most states will require you to go through some kind of financial counseling classes. Many times this is done right online. The classes teach you things about debt and the management of your finances. Their goal is to make sure you never get into this kind of a situation again.

When you finish these classes, you will usually be given some kind of certificate to show that you completed them satisfactorily. This certificate of completion may need to be sent to the state or given to your attorney to prove that you completed the classes.

When you finish these classes, you will usually be given some kind of certificate to show that you completed them satisfactorily. This certificate of completion may need to be sent to the state or given to your attorney to prove that you completed the classes.

You won’t necessarily be mailed a hard copy of this certificate. Most times a simple email might be sent to you for your records.

After completing this course, you will wait for your attorney to give you your court date. While you’re waiting for this, your attorney will typically contact you at some point to advise you regarding the results of his work when it comes to creating your case for the court.

The next thing that will take place is the actual court date. How this transpires will vary, depending on where you’re located. Some states will have you go to an actual courtroom environment, where you will stand before a judge. Others will have you go before a trustee who represents the federal bankruptcy court in your state.

This person is not a judge. They are typically attorneys who are on contract for the bankruptcy courts. Their job is to examine the case paperwork and make sure you have a legitimate reason for filing for bankruptcy. They will probably ask you questions related to your finances. They might ask you how long you’ve been employed. They will probably also ask you questions specific to your financial situation, how much money you make each week, whether you’ve ever filed for bankruptcy before or not and maybe some other similar questions.

Your attorney should have prepared you for this well in advance. As your bankruptcy attorney, part of their job is to prepare you for this. They will look at your situation, your finances, your debs, etc. and create paperwork that documents your case.

They will typically share this information with you before you go before the trustee or the judge. This will prepare you for that specific moment and help you to be able to answer the questions that you’ll be asked.

And when everything is said and done, if your attorney has prepared everything properly, you will be told by the trustee or the judge that your case has been accepted by the court and that your debts will be discharged.

It’s possible that some of your creditors will send representatives to argue the case before the court. They may try to get the court to make you pay part or all of the debt. But this isn’t always the case. And if they do send representatives, don’t worry. Addressing them is your attorney’s job. It’s part of what you’re paying them for.

It’s possible that some of your creditors will send representatives to argue the case before the court. They may try to get the court to make you pay part or all of the debt. But this isn’t always the case. And if they do send representatives, don’t worry. Addressing them is your attorney’s job. It’s part of what you’re paying them for.

At that point, once the judge or trustee says that you’re finished, you are done. Your debts will be canceled and your creditors will never be able to contact you about this debt again. It has been canceled. End of story.

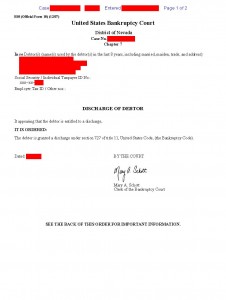

Then, typically within 90 days, you will receive a letter from the bankruptcy court stating that your bankruptcy has been discharged. That’s the final step of the process.

What happens after the bankruptcy is granted?

Now that the bankruptcy has been granted, you can breathe a sigh of relief. Not a single one of the creditors that were part of the bankruptcy petition will ever be able to demand payment for these debts again. It’s now in the past.

What you’ll need to do now is rebuild yourself financially. Start over. Make a fresh start. This is your chance to change things up and learn from your mistakes. This is your chance to take what you’ve learned and rebuild on a solid foundation.

Your credit will be shot at this point. Your bankruptcy will show up on your credit report for many years to come. You will not be able to get a loan, typically for at least two years. The bankruptcy itself will stay on your credit report for up to 7 years! It will eventually fall off, but a bankruptcy on your credit history will follow you for quite some time.

There are ways to rebuild your credit after bankruptcy that can speed up the process, but we won’t get into that here. We can address that in a future blog post.

But suffice it to say that you should plan on using cash only, for at least the next 2 – 3 years. And if possible, maybe you should change your lifestyle and live on a cash-only basis forever. Doing this requires a lifestyle change and a change of mindset. You will need to retrain your mind to think “cash” instead of credit.

But suffice it to say that you should plan on using cash only, for at least the next 2 – 3 years. And if possible, maybe you should change your lifestyle and live on a cash-only basis forever. Doing this requires a lifestyle change and a change of mindset. You will need to retrain your mind to think “cash” instead of credit.

Some people do very well like this. They learn to manage their money better and they never borrow another penny for the rest of their lives. Others prefer to learn from the mistakes and manage their debt better in the future. They learn how to use debt in their favor, instead of the opposite.

If you would like to read more about living on cash only, comment below and let us know. If there’s enough demand, we’ll write some blog posts about this.

We hope this article on CHristians and Debt has been helpful!

So that covers about everything you need to know, with the exception of tiny details. And remember that every person’s situation will be different. There is no such thing as a one-size-fits-all case. Situations vary greatly from one person to the next. So use this information and apply it to your situation in the way that it suits best.

And remember, that debt is something that can always be overcome, one way or another. Debt is not the end of your life. Debt doesn’t have to overtake you. It doesn’t have to define you. Some people can manage debt very well and use it wisely. But look at your situation with an open mind and make wise decisions.

And remember that God wants you to live victoriously. Being in debt doesn’t have to make you feel like you’re a failure. Things like this can teach us some valuable life lessons. So it’s up to us to learn from our mistakes and use that learning to improve our lives and help others.

Philippians 4:13 (NKJV) 13 I can do all things through Christ who strengthens me.

We hope you’ve enjoyed reading about Christians and Debt. And we hope this has been informative and enlightening for you.

Be blessed and look up! Help can be found 🙂

Pastor Curt & Pastor Ellie

If you like this article or know others who will benefit from it, please use the buttons below to share it with others.

For years, I was chained to and was a slave to debt! My fiance and I were convicted that one of the Biblical precepts was becoming debt-free. As we follow the principles, we are walking in the joys and freedom of Heaven! We will be married next week and it is entirely paid for! God is great!

Amen, Tim! Congratulations on making a wise choice and paying off your debt 🙂

We pray for God’s blessings over you marriage.

Pastor Curt & Pastor Ellie

This is a wonderful article, Praise God!! I was in debt some years ago and I prayed for God to help me. I began getting credit card offers with zero percent interest on balance transfers so I took the chance and did it. I paid off my lowest balances first and sent my highest balances the required minimum until I paid off lowest balances at no interest. I did this one by one and when the time ran out on that interest free card I would go to the next interest free card I was offered and moved the cards to that account. This took me a few years but I have been debt free for over 10 years. My credit thanks to God is excellent. I was able to buy a new car in 2010 and paid it off in 2014. I wanted to help my daughter out with a car, I prayed about it and I gave her my car, we sold hers and with the money I gave a down payment and I bought a 2014 on December 23 , 2014 and I finished paying for it on August 2015. God is so Good When you ask HIM how to handle your finances. Now I use only cash and I do have one credit card but it’s used ONLY for emergencies and I limit myself to an amount that I know I can pay. What I learned from all of this debt that I had was that it made my life miserable , sad, and grouchy. But I always gave God my first fruits no matter how much I was in the hole. When I finally got to my wits end (or came to my senses), I cried out to God and HE showed me the way. In my opinion credit cards can be evil if one abuses them and that is very easy to do. This article you have written is helpful and I pray that those who are in debt will cry out to God for help because HE will help. He did it for me many years ago. Then HE helped me buy and pay off 2 new cars. My husband and I have had a house built and we moved into it in June 2015 and we will pay that off with Gods help in 7 years. If God did this for me HE will do it for you. By the way , the credit cards were only mine. My husband does not believe In credit cards. I had gotten myself into this situation and I knew I had to get myself out of it. Thank God we serve a Living and Powerful God who is always there for us no matter what . So everyone who has read what Pastors Curt and Ellie have posted and you are in debt please heed the message because I truly believe it is God saying he doesn’t want HIS people in bondage. Pray, He will help you. God bless you all.

Thank you, Liz, for your wonderful testimony! God is truly awesome, and if we would just listen and follow His leading, our lives would be so much better 🙂

I might add to this blog regarding negotiating a debt amount settlement. Please note that most credit card companies also include a clause in their very fine print contract that if you negotiate a settlement amount less than the actual debt, the company has the right (and in most instances do), report the unpaid amount to the Internal Revenue Service. And this will lead you to yet ANOTHER UNPAID DEBT which is much more serious involving taxes owed to the government. So be very wary of negotiating debt!

Thank you, Suzanne. You’re 100% right. We were aware of this, but forgot to include it in the blog post.

Any debt that is not paid off during a debt settlement is reported to the IRS (or whatever the tax bureau is called in your own country) and it is counted as income, which means you will have to pay taxes on it as though you received it as income for work you performed.

Definitely a trap of sorts that will only hurt your efforts to get out of debt.

Thank you for your help! As a 75-year-old Christian woman who is buried in debt I can never repay and that gets worse everyday, when I go before God to repent for being in this situation, esp at the last part of my life, it is hard to imagine He will forgive me. I ask for His help, but I feel so ashamed, I have to struggle for faith to believe He would help a looser like myself. Every penny of my small income goes to pay my credit cards and loans, so I cannot pay cash for groceries or other necessities. My 1994 van is not working, and I dread having it towed to yet another mechanic and having to charge that, so it sits in my carport, & I am without transportation. Sorry for talking about my woes. I thank you for your most helpful info and well written advise coming from a Christian perspective. Thank you for saying we should not be defined by our debt, which is what I have sadly been doing. God bless you.

Hello Jean, you’re quite welcome! We’re glad to be able to help 🙂

In a situation such as yours, we would very highly recommend that you contact a debt management service ASAP. There is no reason for you to struggle with this debt any longer. If they can’t help you (which is highly unlikely) do yourself a favor and hire a bankruptcy attorney and file for bankruptcy right away.

There is no way that you should continue to allow yourself to be a victim of the credit card companies. Do whatever it takes to get free as soon as you can. And snip those cards up!